The Goods and Services Tax (GST) Council has announced major changes in tax rates, effective September 22, 2025. The revised GST structure aims to bring down prices on essential and daily-use products, while luxury and sin goods will now attract a steeper tax rate of 40%.

These changes are expected to provide relief to middle-class households while discouraging consumption of non-essential and harmful products.

Daily Essentials Remain Tax-Free

Basic necessities such as milk, bread, and curd will continue to enjoy zero GST, ensuring affordability of everyday consumption items.

Major GST Rate Reductions

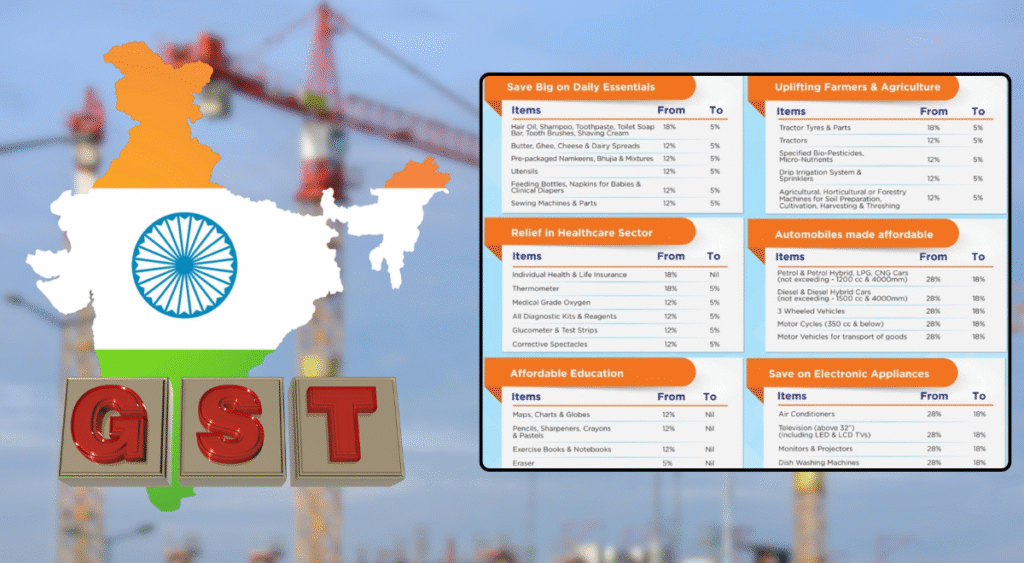

Several categories have received significant GST cuts:

- Hair oil, shampoo, and toiletries – reduced from 18% to 5%

- Butter, ghee, and cheese – reduced from 12% to 5%

- Personal health & life insurance – reduced from 18% to Nil

- Air conditioners, TVs, refrigerators – reduced from 28% to 18%

- Small cars (below 1200cc) and bikes (below 350cc) – reduced from 28% to 18%

- Tableware, kitchenware, bamboo furniture – reduced from 12% to 5%

- Stationery items like pencils, charts, globes, and notebooks – reduced from 12% to 5%

- Hotel tariffs up to ₹7,500 – reduced from 12% to 5%

- Agricultural machinery including tractors, sprinklers, and drip irrigation systems – reduced from 12% to 5%

- Cement – reduced from 28% to 18%

These reductions are expected to ease the cost of living, boost the housing sector, and encourage domestic manufacturing.

Higher GST for Luxury and Sin Goods

While essentials and common-use products see tax relief, luxury and harmful products will now face higher GST:

- Aerated, sugary, and caffeinated beverages – hiked from 28% to 40%

- Luxury cars and premium bikes – hiked from 28% to 40%

- Tobacco, cigarettes, and other sin goods – hiked from 28% to 40%

The move is aimed at discouraging unhealthy consumption patterns while ensuring higher revenue generation from luxury spending.

Industry & Consumer Impact

- Households will see reduced costs on food, personal care, appliances, and insurance.

- The auto industry is likely to benefit from reduced GST on small cars and two-wheelers, potentially boosting demand.

- Cement rate cuts are expected to bring down housing and infrastructure costs.

- The hospitality sector may see increased occupancy with lower hotel tariff GST.

- Luxury and beverage companies may face margin pressure due to higher taxes.

Conclusion

The new GST rates from September 22, 2025 represent a consumer-friendly reform with a dual focus: making essentials more affordable while taxing luxury and sin goods more heavily. This realignment is expected to give a push to consumer demand, real estate, agriculture, and manufacturing sectors, while aligning with the government’s health and social priorities.

Disclaimer: This article is for informational purposes only and is based on publicly available GST Council updates. Actual tax implementation may vary based on government notifications and state-level directives. Readers are advised to consult official sources or tax experts before making financial decisions.